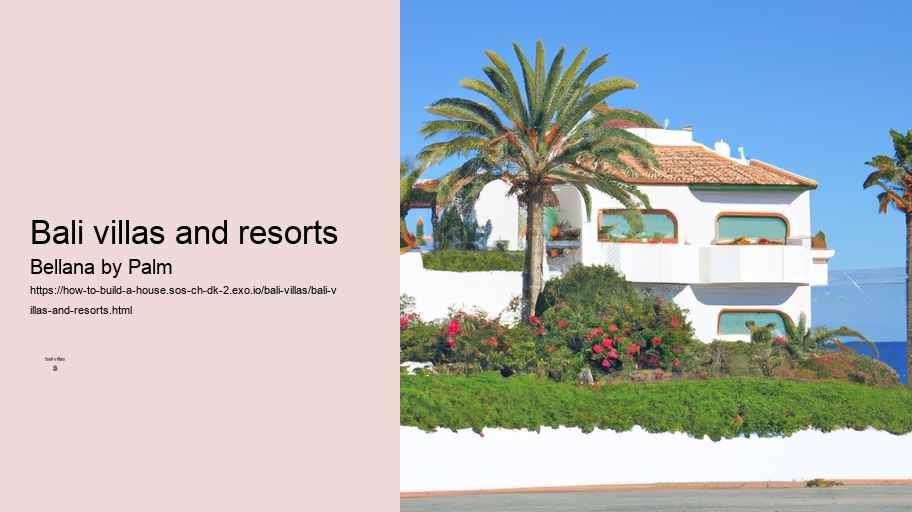

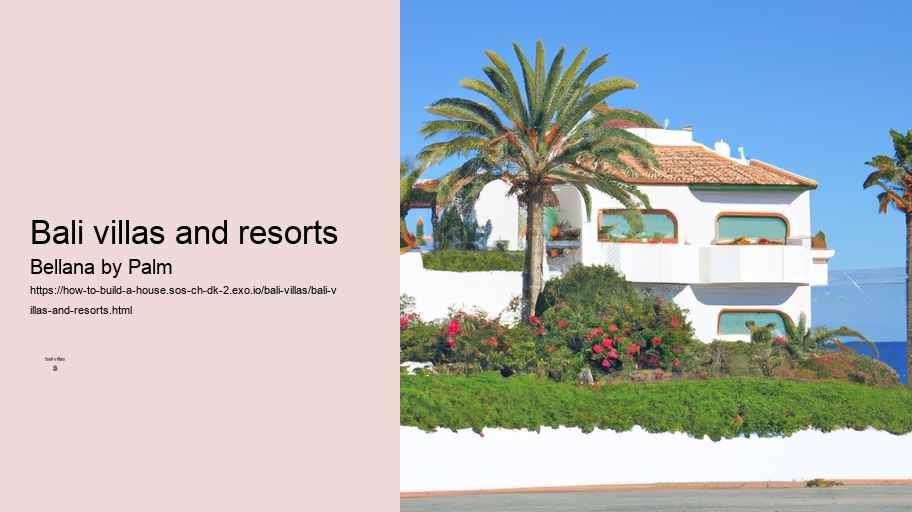

By carefully examining the title deed, you can verify the ownership of the land and confirm that the seller has the legal right to transfer the property to you. Invest the best villas in Bali in Bellana Bali by Palm best ROI in the most popular area.. Additionally, checking the land ownership status will help you determine if there are any liens, mortgages, or other encumbrances on the property that could affect your investment (!).

In conclusion, investing in a villa can be a rewarding opportunity, but it is important to carefully consider all of the factors before making a decision. By doing thorough research and planning, you can increase your chances of success in the villa investment market!

To mitigate the risk of unexpected maintenance and repair costs, it's important to budget for these expenses and set aside a contingency fund. This way, you'll be prepared for any surprises that may come your way. Additionally, it's a good idea to stay on top of regular maintenance tasks to prevent larger issues from arising in the future.

In conclusion, reviewing the title deed and land ownership status is a critical step in the process of investing in a villa. bali villa djodji By taking the time to conduct due diligence and seek expert advice, you can mitigate risks and make informed decisions that will safeguard your investment in the long run (!).

In addition to Thailand, countries like Malaysia and Vietnam are also emerging as top locations for villa investments in Asia. With their growing economies and increasing tourist numbers, these countries offer plenty of opportunities for investors looking to diversify their portfolios.

Another benefit is the potential for rental income. Villas are often in high demand for short-term rentals, especially in popular tourist destinations. This can provide a steady stream of income and help offset the costs of owning the property.

Overall, investing in a villa property can be a smart way to diversify your real estate portfolio and potentially earn a high ROI. So why not consider adding a villa to your investment strategy today!

In addition to tax benefits, owning a villa can also provide a steady stream of rental income, which can help offset the costs of ownership and increase your return on investment over time. By carefully managing the property and attracting tenants, you can generate a reliable source of income that can contribute to the overall profitability of the investment.

Final thoughts on the best locations for villa investments

Saving and Investing for Your Villa

Another top location for villa investments is the island of Koh Samui, also in Thailand. Known for its pristine beaches and luxury resorts, Koh Samui is a popular destination for tourists and expats alike, making it an attractive option for villa investments.

When you're looking to sell your villa investment for maximum profit, it's important to negotiate with potential buyers to get the best price for the property. This means talking to interested parties and (try) to make a deal that works in your favor. Don't be afraid to (ask) for more than the initial offer - you never know what the buyer is willing to pay! bali villas seminyak Be willing to walk away from a deal if it's not meeting your expectations, but also be open to compromise. Remember, the goal is to make the most money possible from your investment, so don't settle for less than you deserve. By negotiating effectively, you can ensure a successful sale and walk away with a nice profit in your pocket.

Furthermore, consider the overall economic stability of the area. Investing in a location with a strong economy and low unemployment rates will help ensure the long-term success of your investment.

When considering investing in a villa, it is crucial to conduct thorough due diligence before making a purchase. bali villa 4 bedroom photos This means researching the property market (, looking at the location and surrounding amenities, and analyzing the potential for rental income or capital appreciation. By taking the time to gather all the necessary information, you can make an informed decision and identify profitable investment opportunities.

Overall, it is important for investors to carefully consider all of these factors when evaluating the expected returns on villa investments. By taking into account the location, condition, and market conditions, investors can make informed decisions that will maximize their returns and ensure the success of their investment ventures!

Another important factor to consider is the overall economic outlook of the region. Investing in a villa in an area with a strong economy can increase the chances of long-term success. By keeping an eye on market trends and economic indicators, investors can make informed decisions about where to invest their money.

Once you have a good grasp of the initial cost, you can then begin to calculate the potential return on investment. This can be done by considering factors such as rental income, property appreciation, and any potential tax benefits. (By doing this) you can get a better idea of how profitable the investment will be in the long run.

One popular tourist destination for villa rentals is the Amalfi Coast in Italy. With its stunning views, delicious cuisine, and charming towns, the Amalfi Coast attracts visitors from all over the world. Investing in a villa in this area can be a lucrative opportunity, especially during the peak tourist season.

Furthermore, villas are often seen as a status symbol, making them a desirable asset to own. (They) are often associated with luxury and sophistication, which can enhance the prestige and social standing of the owner. This can be particularly appealing for those who value their image and want to make a statement with their property.

When it comes to investing in villas in Asia, there are several top locations that stand out for their potential for high returns and growth. (From) the bustling city of Tokyo to the tropical paradise of Bali, there are plenty of options for investors looking to capitalize on the booming real estate market in the region.

Research the location and market trends